Have you been contemplating taking the plunge and buying a new house? Figuring out when to buy in today’s real estate market can be quite intimidating—especially when prices are high, choices are limited, and anxiety over the market is high.

"We’ve seen two or three years of what could be considered unsustainable levels of price appreciation, as well as an inventory shortage that resulted in a record-low number of homes for sale across the country," says Javier Vivas, director of economic research for Realtor.com®. "When you factor those together, you have a market that has to either explode or see some relief."

Experts agree that relief is indeed on the horizon. North Carolina is seeing a boom in home sales; and depending on where you live (and how much you plan to finance), these factors combined could mean 2018 will be the year to take the buying plunge.

There are a few key items to keep an eye on in 2018, the first being the interest rate increases. Rates are going up! After years of record-low interest rates the Fed is finally making some noticeable increases. The rate for a 30-year fixed mortgage broke the 4% mark last year. And with economic growth continuing to carry momentum, predictions are that there will be at least two to four more rate increases throughout 2018. Rates are anticipated to hit 5% by the end of the year. These increases will constrict home affordability. The more home buyers wait, the more expensive it will get to buy—not just because of home prices, but because of inflation.

With interest rates holding in the low 4% range for now and if you’re in the market, it’s a good time to take advantage before rates go up. In other words, if you want in on the American dream, now might be the time.

Secondly prices are climbing, slow but steadily. Home prices have soared over the past few years, pricing otherwise well-positioned buyers out of high-cost areas and leading some experts to cry "bubble". But in 2018, price increases are expected to moderate. Forecasts show a possible home price increase of 3.2% year over year, after finishing 2017 with a 5.5% year-over-year increase. Existing-home sale prices are predicted to increase 2.5% year over year.

Of course, it all depends on where you live. Sales numbers and home prices are poised to climb in Southern states, like here in North Carolina, where economic momentum continues chugging along and new construction is happening in the right price points. What does that mean? Basically, home prices will still increase, but not at the same pace as they have over the past few years. If you’re in the market for a home, it might be a good idea to get preapproved and start shopping as soon as possible before prices go up.

Another key indicator to watch in 2018 is the increase in Inventory levels. A home inventory shortage has plagued the U.S. housing market since 2015, forcing some buyers to settle for less and keeping others out of the buying market entirely. By fall of 2018 the tides are expected to turn. Predictions are that the majority of inventory growth will happen in the middle- to upper-tier price point, in the ranges of $350,000 and $750,000 and above $750,000.

New home construction is also expected to expand. But that will happen slowly, thanks to a constricted labor market, limitations on the amount of lots and land that's available, tight bank financing for building loans, and a run-up in building material prices, says National Association of Home Builders chief economist Robert Dietz. Buying could make a ton of financial sense. If saving money is or has been an obstacle, there are many low down payment options. The conventional wisdom that you need to put 20% down has become a myth. Depending on the loan type you qualify for, you could get into a primary home with anywhere between 3% – 5% down.

National housing starts are expected to increase 3% over the next year, and of particular interest to first-time home buyers may be the fact that single-family home construction will increase at a rate of 7% over the next year. Many home buyers are young and looking for starter homes. The inventory in recent years has been increasing in higher-priced homes that don’t always match the needs of the market. The good news is an increase in single-family home construction helps address this problem. It's particularly tough for builders to break ground at the entry level for first-time buyers, particularity in high-cost coastal markets such as California. That means it will take longer for those inventory levels to recover.

And there's another bright spot: Builder confidence is at its highest level since 1999, according to the NAHB. And that means hope is on the horizon. Heading into 2019 and beyond, inventories are expected to increase and provide relief for first-timers and drive sales growth.

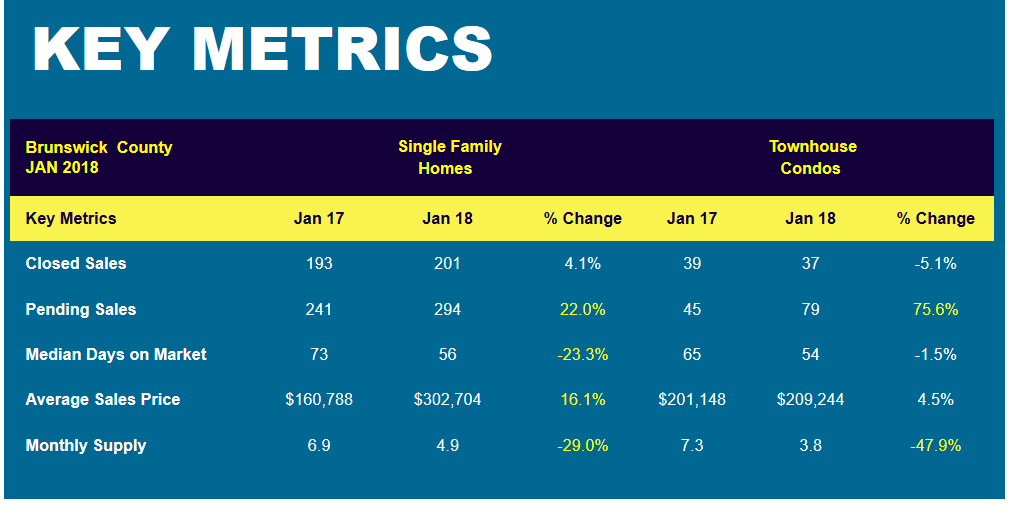

Riptide is seeing massive growth in the Sunset Beach area of Brunswick County. From the chart below, courtesy of Cape Fear Realtors, it’s easy to see local numbers of what’s happening.

And the last wild card is the state of taxes and politics. When the Republican tax plan was introduced, the proposed elimination of the mortgage interest deduction was a key point. The new limitations on the deduction will affect only 2.5% of all existing mortgages in the U.S. Across the board, experts agree that the new tax plan decreases incentives for home ownership and reduces the tax benefits of owning a home, but on the flip side, that means that if fewer folks are motivated to buy, then there’s less competition for those who want in the game. Some taxpayers will see a tax cut. That increase in buyers' disposable income could spur demand from folks who are looking to build equity as a homeowner.

And the biggest big reason to buy a home at any point in time is just the fact that it would be yours. When you have your own home, it opens up all sorts of options for you, both financially and aesthetically, that you wouldn’t have if you were renting.

If you’re in the market, rates are still low. It remains a great time to buy. If you’re considering a buy this year make sure to check out Riptide Builders product line in Brunswick and Horry counties. We offer new home sales in the Sunset Beach, Ocean Isle Beach, Myrtle Beach and Carolina Forest areas.